Investing through the ups & downs

What’s ahead

Keep calm and invest on

What’s dollar-cost averaging?

Celebrating Women’s History Month

Spring forward with your finances

Keep calm and invest on

Earlier this month, investors saw the Dow and S&P 500 decline, sparking widespread uncertainty. While market dips can be unsettling, they’re a normal part of investing. But what do these drops really mean for your investments?

The Dow Jones Industrial Average and S&P 500 are indexes that track the overall performance of the U.S. stock market. When they rise, it generally signals that stocks are gaining value, which benefits investors. When they fall, as they did recently, it can create a lot of uncertainty.

Market ups and downs are inevitable, and even the most experienced investors find it challenging to navigate volatility. When the market gets rocky, it’s natural to feel the urge to react quickly — but impulsive decisions often do more harm than good.

A well-balanced, diversified portfolio is your best defense against market turbulence. It’s key to long-term market participation and central to building generational wealth. Investing strategies, like dollar-cost averaging, can help you navigate ups and downs. Now is a great time to revisit your investment strategy and ensure it aligns with your long-term goals.

Remember: risk is always a factor in investing — the key is managing it wisely.

What’s dollar-cost averaging

Dollar-cost averaging is an investing strategy designed to reduce the average cost per share of an asset while making investing feel more manageable — especially for cautious investors. But how does it work?

Let’s break it down using ETFs, since that’s what we use at Stackwell.

Say you have $500 to invest. You could invest it all at once, buying $500 of an ETF today. But if the price drops next month, your entire investment is exposed — meaning it’s worth less than what you originally put in. Even if you expect the price to recover, the stress of market fluctuations can lead to not-so-strategic financial decision-making.

Dollar-cost averaging takes a different approach. Instead of investing the full $500 at once, you break it up into smaller, consistent investments — say, $50 per month over 10 months. If the price drops next month, you still invest $50. If the price rises the following month, you invest another $50. Over time, this strategy helps lower your average cost per share and smooths out the impact of market volatility.

By setting a fixed investment amount each month, dollar-cost averaging removes the pressure of trying to time the market. While no strategy guarantees returns, it can be a smart way to stay consistent and focused on long-term growth.

This month, and whenever we see market turbulence, dollar-cost averaging helps investors worry less about the day-to-day market fluctuations.

Celebrating Women’s History

At Stackwell, we often focus on the racial wealth gap — but that conversation isn’t complete without acknowledging how the gender wealth gap is deeply intertwined.

Women, especially Black and Latinx women, face disproportionate barriers to building wealth in the United States. Research shows that never-married Black women hold just 8 cents in median wealth for every dollar held by never-married white men, while Latinx women hold just 14 cents. Single mothers feel this gap most acutely.

Like the racial wealth gap, this gap is the result of systemic barriers that limit access to income, investing, and long-term wealth-building opportunities.

This Women’s History Month, we’re reaffirming our commitment to breaking those barriers down.

We’re working hard every day to perfect a platform and programs that make investing accessible to everyone — and we’re getting good at it.

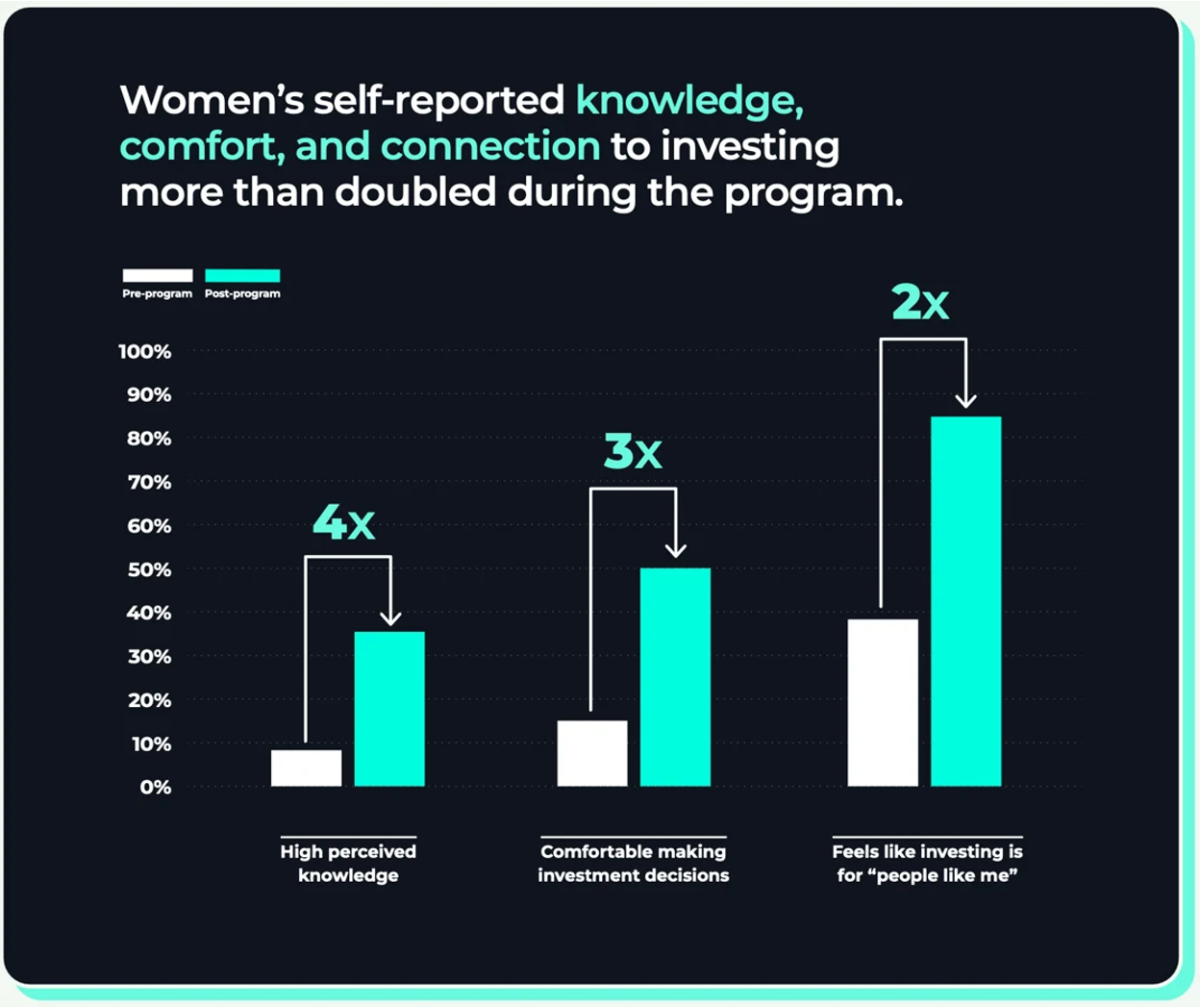

According to the Financial Health Network’s recent impact study of one of our programs, female participants’ knowledge, comfort, and connection to investing doubled over the course of a Stackwell program.

That’s the power of representation, financial education, and meeting investors where they are.

This Women’s History Month, we remain committed to breaking down barriers, expanding access, and ensuring that wealth-building isn’t just for the few — it’s for everyone.

Spring forward with your finances

Spring cleaning isn’t just for your home — it’s the perfect time to tidy up your finances, too. Just like cleaning out clutter makes a space feel fresh, a financial check-in can help you feel more in control of your money.

Here’s a few tasks to get you started:

Review your budget: Take a moment to assess where your money is going. Are there any areas where you’re overspending? Updating your budget ensures it aligns with your current financial goals and helps keep spending in check.

Track your spending: If you haven’t already, keep a closer eye on your spending habits for the next month. Identify areas where you could cut back, and allocate that extra money toward savings or investing. Tracking your spending helps you stay mindful of your financial health.

Check in with your savings plan: Take a look at how your savings are progressing. Are you on track to meet your short- and long-term goals? If not, consider adjusting your plan by setting up automatic transfers or increasing your savings percentage.

Cancel any subscriptions you don’t use: Unused subscriptions add up over time. Review your subscriptions to see if you’re still using all of them, and cancel those you no longer need. This can free up extra funds for more important financial priorities.

If you’re investing with Stackwell, now is also a great time to revisit your automatic contributions. In the app, head to the Home page and check out our investment growth calculator to see how much your wealth can grow over time. A little effort now can pay off big, setting you up for a stronger financial future — just like a thorough deep clean sets the stage for a fresh start.