Investing, simplified

Investing, simplified

Your wealth journey starts here.

When you open the Stackwell app, we make it easy to start investing — no stress, no jargon. You tell us your goals, and we help you build a personalized portfolio designed for long-term growth.

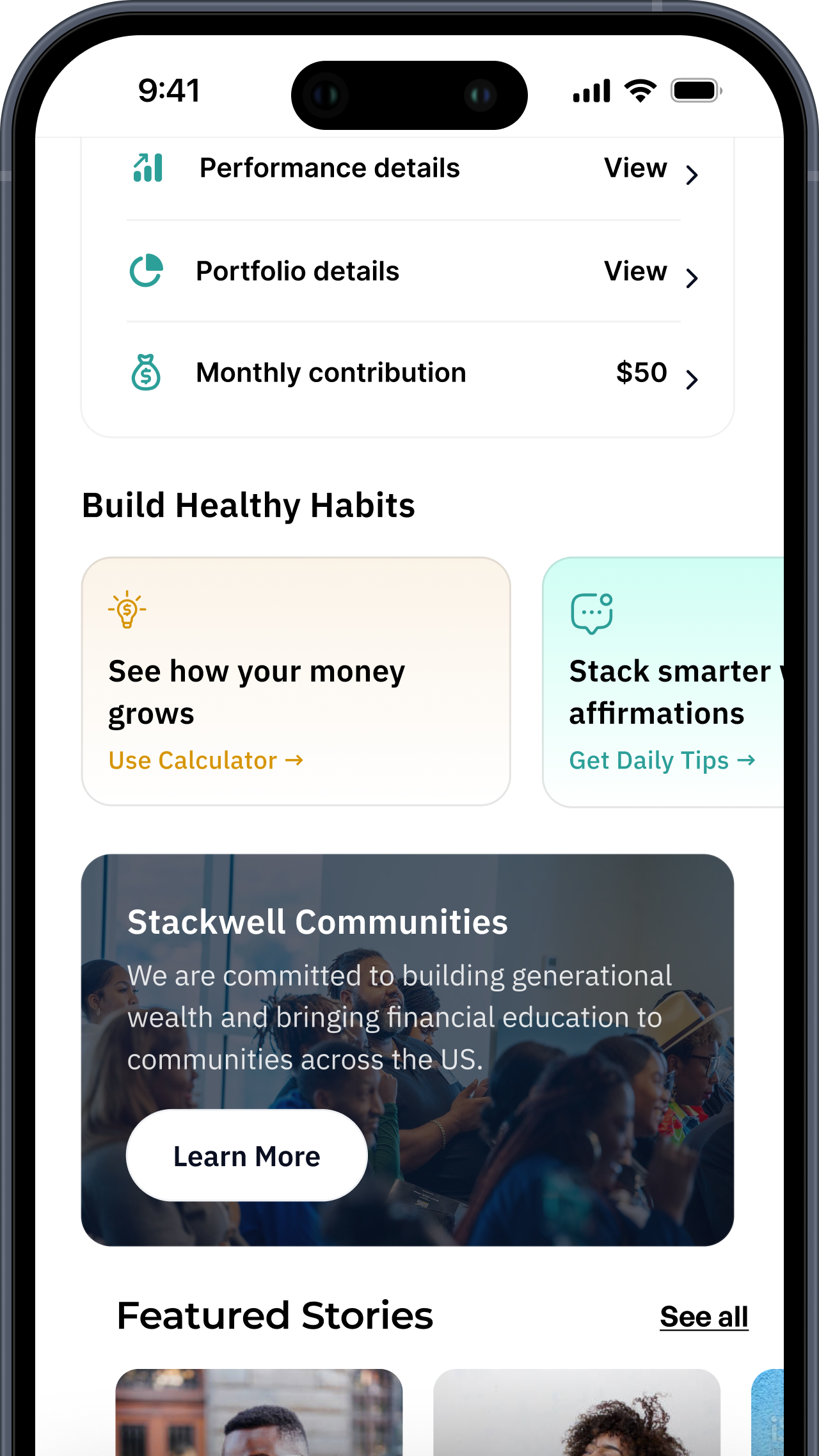

Our tools to keep you on track.

Building wealth takes consistency — so we make it easier to stick with it. We focus on the habits that help you build real, lasting wealth.

-

Use the growth calculator to visualize your potential over time

-

Get nudges and reminders based on your investing behavior

-

Stay motivated with gamified milestones and progress tracking

Three steps. Limitless possibilities.

-

1. Set it

Open your account, drop in funds, and you’re ready to go.

-

2. Forget it

Automatic contributions keep your money moving.

-

3. Let it grow

Sit back as your stack grows and your goals get closer.

Three steps. Limitless possibilities.

When you open the Stackwell app, we make it easy to start — no stress, no jargon. You tell us your goals, and we help you build a personalized portfolio designed for long-term growth. You don’t have to pick stocks or time the market. Just set it, fund it, and let your money work for you.

Harness the power of investing.

It’s not about timing the market — it’s about time in the market. You don’t have to choose what stocks to buy or sell or when. Our powerful robo-advisor does that for you so you can grow your wealth with confidence.

Harness the power of investing.

It’s not about timing the market — it’s about time in the market. We do more than help you get started — we help you build habits for long-term wealth-building.

FAQ

For questions, email us at support@stackwellcapital.com.

-

When you open a Stackwell account, you’re opening an account for investing, commonly known as a brokerage account.

As you get started, we will ask you questions to get to know your investment goals and risk profile—a sense of how willing and able you are to take on risk while investing. For some investors, a riskier investment is worth the potential for higher earnings. For others, slow and steady growth from low-risk investments is preferable.

Unlike other investing apps, you won’t pick your own stocks on the Stackwell app. We believe investing should be stress-free. That’s why our mission is to help you grow your wealth by offering investment strategies tailored to your goals.

From your profile, Stackwell recommends a portfolio made up of equity and fixed-income Exchange Traded Funds (ETFs)—collections of stocks and bonds that meet your investing goals.

You can easily track your progress and transfer funds in and out of your portfolio in the Stackwell app.

-

By law, Stackwell must verify a person’s identity before opening their investment account.

There are four key attributes commonly used to confirm a person's identity in the United States:

Full name

Address

Date of birth

Social security number

Without these details, we are unable to verify your identity and open your Stackwell account.

In addition to our legal obligation, verifying your identity protects you. Our identity checks are meant to ensure someone trying to open an account “as you” really “is you.”

-

At Stackwell, we take the privacy and security of our users very seriously. We don't share your personal information with anyone throughout and after the identity check process. We do not sell your information to third-party sellers.

-

Although there is always some financial risk associated with investing, Stackwell makes sure your money, data, and personal information is safe.

We take security and data privacy very seriously. We offer 256-bit encryption for your personal data and information, 24/7 monitoring for unusual activity, and two-factor authentication to secure access to your account.

-

You can see what kinds of assets are within the Exchange Traded Funds (ETFs) that make up your portfolio under Portfolio Details in the Stackwell app.

You can see the real-time value of your portfolio under Performance Details in the Stackwell app, which shows you the composition and value of your stack.

-

Deposits usually take about 1-2 days for the cash to process. After that, it can take another 2-3 days for your investments to be fully set up.

-

Withdrawing funds usually takes 3-5 business days. This is because Stackwell has to sell some or all of your investments to get the cash.

Selling securities typically takes at least 2 business days. After we complete the withdrawal, your bank might take another 1-2 days to show the money in your account.

-

Stackwell Capital Advisers, LLC is an SEC-registered Investment Advisor, and brokerage services are provided to clients by Apex Clearing Corporation, an SEC-registered broker-dealer and member of FINRA /SIPC. All investments held by Apex are protected by the Securities Investor Protection Corporation (SIPC).

Stackwell Investment accounts are in the custody of Apex Clearing Corporation which is SIPC-protected up to $500,000 total, including $250,000 in cash balances. This protects against losses resulting from the failure of a broker-dealer. The $500,000 amount is standard for investment companies.

For any questions about our compliance policies, email us at support@stackwellcapital.com.

-

Customers must be at least 18 years old to open a Stackwell account. At this time, Stackwell's app is only available to United States residents who have a valid Social Security number. Additionally, Stackwell is currently not available to people working for a brokerage firm.